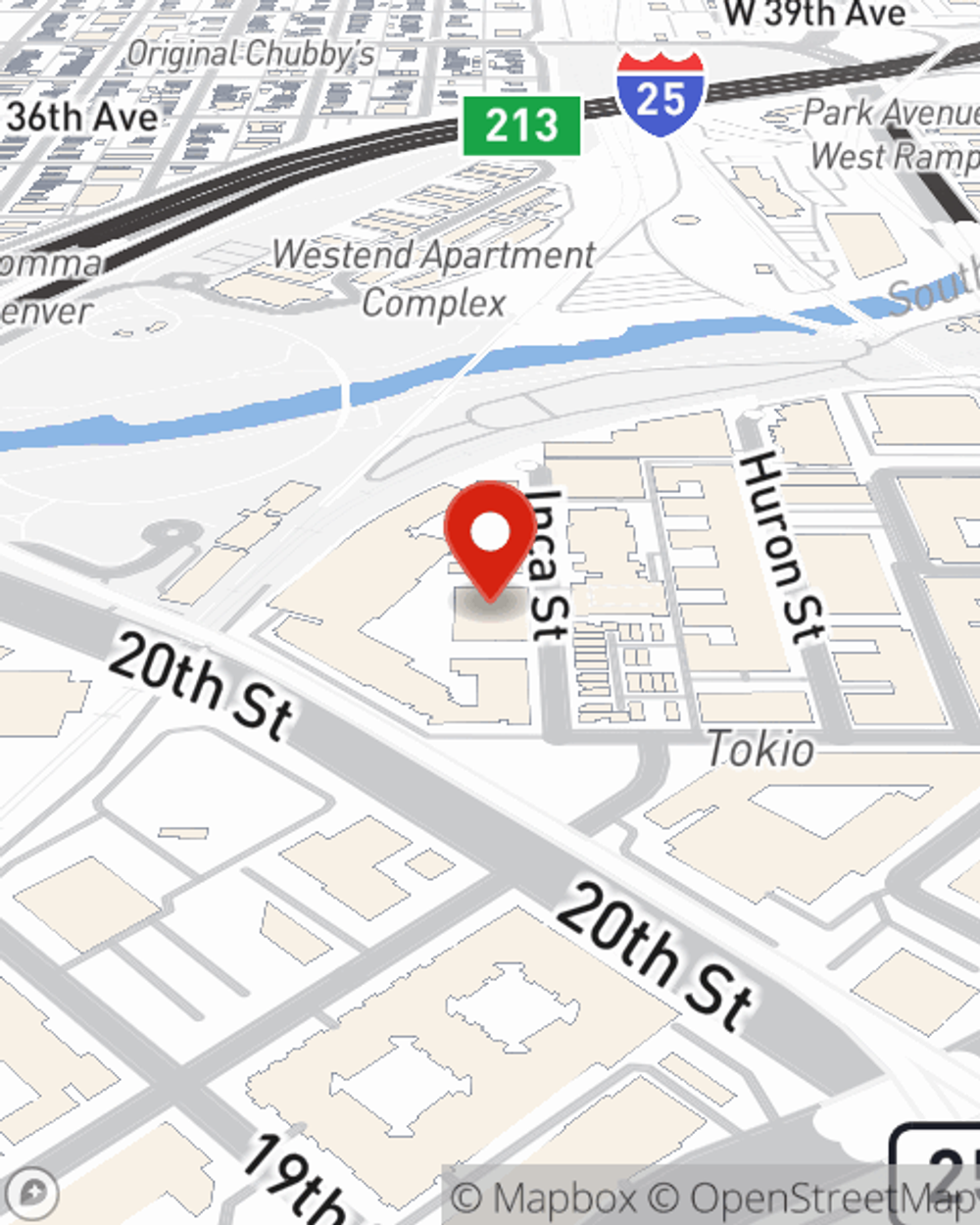

Business Insurance in and around Denver

Researching protection for your business? Search no further than State Farm agent Paul Farr!

No funny business here

Your Search For Excellent Small Business Insurance Ends Now.

Operating your small business takes effort, time, and terrific insurance. That's why State Farm offers coverage options like a surety or fidelity bond, business continuity plans, worker's compensation for your employees, and more!

Researching protection for your business? Search no further than State Farm agent Paul Farr!

No funny business here

Strictly Business With State Farm

Your company is one of a kind. It's where you earn a living and also how you make a life—for yourself but also for your loved ones, and those who work for you. It’s more than just a shop or a store. Your business is a reflection of all your hopes and dreams. Doing what you can to keep it safe just makes sense! That's why one of the most sensible steps is to get outstanding small business insurance from State Farm. Small business insurance covers numerous occupations like an electrician. State Farm agent Paul Farr is ready to help review coverages that fit your business needs. Whether you are an electrician, an optometrist or a plumber, or your business is a shoe store, a dental lab or an auto parts shop. Whatever your do, your State Farm agent can help because our agents are business owners too! Paul Farr understands the unique needs you have and is ready to review coverages that meet your needs. With State Farm, you’ll be ready to grow your business into a bright future.

Agent Paul Farr is here to explore your business insurance options with you. Contact Paul Farr today!

Simple Insights®

Trailer insurance coverage

Trailer insurance coverage

Consider trailer insurance coverage to help protect the value of your trailer.

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.

Paul Farr

State Farm® Insurance AgentSimple Insights®

Trailer insurance coverage

Trailer insurance coverage

Consider trailer insurance coverage to help protect the value of your trailer.

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.